The search for a better investment recipe

Simply sign up to the Investments myFT Digest -- delivered directly to your inbox.

Anybody who has tried to bake a cake will know there are lots of things that can go wrong, from burnt tops to soggy bottoms. And that can even happen when bakers are trying to follow a recipe.

When it comes to assembling an investment portfolio, there is no set of instructions guaranteed to deliver success, since we cannot forecast the future with any certainty. To pursue the analogy, the same approach might produce a rich chocolate cake in one climate, but an inedible mess in another.

Instead of an exact formula, investors tend to be guided by vague aphorisms, or rules of thumb. A classic example is the instruction to diversify, not simply in the sense of owning a wide range of shares, but in different asset classes, or across different countries.

But investors can be forgiven for wanting a bit more precision. After all, since the turn of the millennium, there have been crashes in internet stocks (which many people thought were the best hope for the future); US houses (which many thought would never fall in price); and, most recently, the collapse of several well-established American banks (which many believed were too well run to get into difficulties).

One of the oldest rules of thumb is the 60/40 split, with 60 per cent of the portfolio in equities and the remainder in government bonds. The idea is that equities will provide growth and government bonds income while the steadiness of the bond portion of the portfolio will make up for the volatility of the equities.

But even this principle is now under challenge. The BlackRock investment institute, the research arm of the fund management giant, said that the 60/40 model would not work well in coming years, since central banks were likely to be vigilant in combating inflation. “We don’t see the return of a joint stock-bond bull market” the institute said.

When the world’s largest institutional investor questions a commonly-held principle, it’s time to take notice. Even retail investors, who often don’t have the time or expertise to follow every twist in the market, should look at their portfolios in a new light.

Unstable correlations

The 60-40 proportions have always been a bit arbitrary. Benjamin Graham, mentor of the great investor Warren Buffett, suggested a 50/50 split. But such simple rules also have their merits. If maintained over time, investors will need to rebalance their portfolios; selling those assets which have risen most sharply in price and buying those which have underperformed.

Implicit in these approaches is the idea that equities and bonds perform well in different economic conditions. Equities do best when the economy is growing, and corporate profits are rising. They tend to suffer during (or just before) economic recessions as investors anticipate falling profits. A classic example was the financial crisis of 2008-09 which was accompanied by a deep recession, and led to a deep equity bear market.

The income and repayment values of most bonds are fixed, so investors suffer when inflation is high and the real value of the asset declines. During the period 1970-1981, when British inflation was sometimes in double-digits, investors in UK government bonds, or gilts, lost 43.5 per cent of their money in real terms.

On occasions, however, equities and bonds can lose money at the same time. That is what happened in 2022 when the S&P 500 index and long-term US Treasury bonds both suffered double-digit percentage declines. A sudden rise in inflation forced central banks around the world to push up interest rates. Bonds were hit by inflation and equity prices were damaged by fears that higher rates would lead to recession.

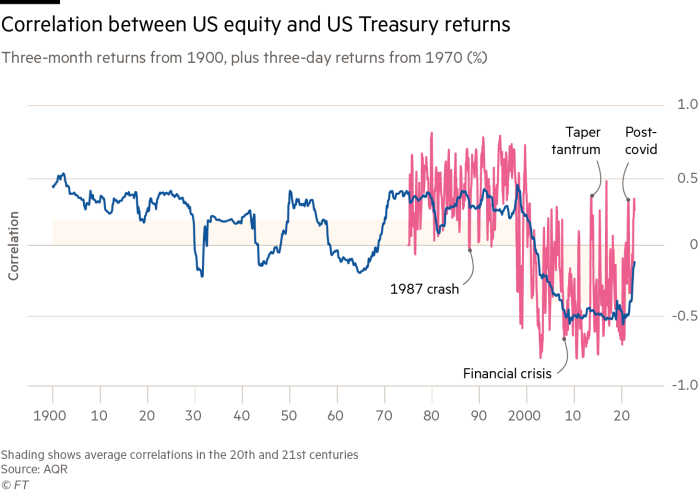

Over the long term, the correlation between equities and bonds has been far from stable (see graph). In the 1980s and 1990s, both equities and government bonds rose in price, a positive correlation that was great news for investors. The correlation was negative in the first two decades of the 21st century, which was still useful. But a prolonged period in which both equities and bonds fall in price, as happened in the 1970s as well as 2022, would be disastrous.

Focus on value

Valuations are a particular problem at the moment. Investment return comes in two forms. Income results from the payment of interest (on bonds and cash), rent (on property) and dividends (on equities). Capital gains occur as assets rise in price. The biggest capital gains come from equities and property, but short-run capital gains can be earned on bonds, particularly if their price is below their repayment, or maturity, value.

A key valuation measure is the yield, or the income from an asset, divided by the price. As the income is constant (in the short run), as asset prices rise, yields fall. That is exactly what happened in the 1980s, 1990s and 2000s. At the end of 1981, the yield on the 10-year US Treasury bond was 12.6 per cent while the yield on the S&P 500 index was 5.4 per cent. By the end of 2020, the 10-year Treasury bond yielded just 1.1 per cent and the S&P 500 index 1.6 per cent. While dividends grew, asset prices rose much faster. In effect, investors had a strong tailwind aiding their progress.

But this process must eventually run out of road. The income from both asset classes has become so low that investors are largely relying on capital gains. In theory, investing at a time when yields are high, means that the expected return will also be high. Conversely, when yields are low, returns are also likely to be disappointing. Although yields rose in 2022, they are still low by historic standards; the 10-year Treasury bond yields 3.4 per cent and the dividend yield on the S&P 500 index just 1.7 per cent.

This causes some to be pessimistic about the outlook. Antti Ilmanen of the US investment firm AQR, is well known for his analysis of the components of long-term returns. In his 2022 book Investing Amid Low Expected Returns, he argued that investors had benefited from windfall gains in almost all asset classes over multiple decades as real yields fell and asset valuations rose.

The bad news, wrote the 61-year-old quantitative investment specialist, was that “harsher investment conditions are ahead” whether it be the “slow pain” of low income returns or “the fast pain of losses when rich asset valuations revert to more normal levels”.

If he is right, investors have a problem: a 60/40 equity-bond portfolio is no use if both asset classes are likely to deliver disappointing returns. Ilmanen and BlackRock suggest similar solutions. First, invest in a wider range of assets. Second, be more selective within the two main asset categories.

Alternative assets

The two other traditional asset classes are cash and property. After years of earning barely any interest on their accounts, UK savers can now get 3-4 per cent if they shop around. Given that inflation is still over 10 per cent in Britain, such returns are very negative in real terms. Having some cash is always useful to meet sudden financial commitments. But it is hard to make the case for it as a substantial part of a long-term portfolio.

Many retail investors will already have a substantial property exposure through home ownership. Some may have an even bigger interest via the buy-to-let market. Residential property is generally seen as a good hedge against inflation. But rising interest rates are bad news for those who have borrowed money to buy property, and houses already look expensive. Nationwide, the building society, compares UK house prices for first-time buyers to their earnings; in the first quarter of 2023, that ratio was 5.4, close to its record high, and compared with a 40-year average of 3.8.

Commercial property also struggles when interest rates are rising. Charlie Munger, Buffett’s longtime associate, recently observed that “a lot of real estate isn’t so good any more”. Office blocks have been hit by the trend of working from home, while shopping malls have been badly affected by internet shopping. Property funds face a mismatch between the illiquidity of their portfolios and the ability to allow redemptions; there was a rush to withdraw money last autumn from such funds after the UK government’s disastrous “mini” Budget. On occasions, funds have had to halt redemptions.

Commodity futures have offered a historic return of 3 per cent over cash, according to Ilmanen. But this is true of a diversified basket; individual commodities are highly volatile. This is a risky area of the market which small investors lack the expertise to exploit.

As for cryptocurrencies, the Financial Conduct Authority points out that many “have no tangible assets that sit behind them”, that it is a largely unregulated market in which scammers are increasingly active, and that investors “should be prepared to lose all your money”.

Institutional investors have been increasingly enthusiastic in recent decades about “alternative assets”, such as private equity funds which invest in companies that are not quoted on the stock market. The claim is that private companies can operate more efficiently when not under the scrutiny focused on listed companies.

The long-term performance of private equity funds is extremely good, beating the S&P 500 index. But the sector may struggle to match this record in future. There is now a much smaller valuation gap between private and publicly quoted companies and more competition for target companies, making bargains harder to find.

In any case, it is hard for the average saver to invest directly in a private equity fund, as the minimum amounts needed are substantial. Venture capital trusts are accessible and have attractive tax breaks, but they need to be held for at least five years. And there are obviously risks involved in devoting a large part of the portfolio to young, unquoted companies.

Tactics rather than strategy

Alternative assets are either too risky or out of reach for the average retail saver.

So the best option for small investors might involve being more selective within the main asset categories. If overall returns are going to be lower, then seeking out the most likely source of positive real returns seems sensible. Index-linked gilts are bonds issued by the UK government whose repayment value and annual interest rates are linked to inflation. Counter-intuitively, they performed poorly in 2022, even though inflation rose sharply.

Why was that? For many years, index-linked gilts were highly sought after by pension funds. This drove the price up and the yield down. The yield was so low that in real terms it was negative. This corrected sharply last year as gilts fell in price and real yields are now more appealing. A recent sale of index-linked gilts, maturing in 2045, offered a yield 0.65 per cent above the annual increase in the retail price index. At least, if held till maturity, that is a positive real return.

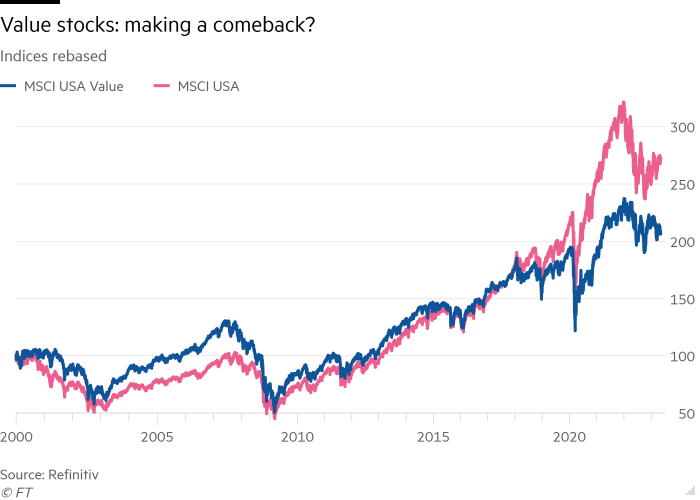

Within equities, it may be possible to enhance returns by following a particular investment “style”. The best known is value investing, which aims to buy stocks that look cheap relative to various measures, such as the company’s assets, profits or sales. This tactic had a very good long-term record until the 2010s when it performed dismally as everyone piled into technology stocks, which are prized for their potential growth not their cheapness. Value did make a comeback in 2022 and Rob Arnott of Research Affiliates, an investment firm, says that there’s “ample room for value to perform brilliantly in this decade”.

Other opportunities to enhance returns may occasionally arise. The spread, or excess interest rate, paid by the issuers of riskier corporate bonds (usually dubbed high yield) was very high in the early 2000s, during the financial crisis of 2008-09 and at the start of the pandemic in 2020. Those turned out to be good times for bargain hunting. Sadly, spreads are not particularly high at the moment. “If you’re concerned about the possibility of recession, these current valuations in investment-grade credits aren’t very appealing,” says Alfonzo Bruno of Morningstar Investment Management.

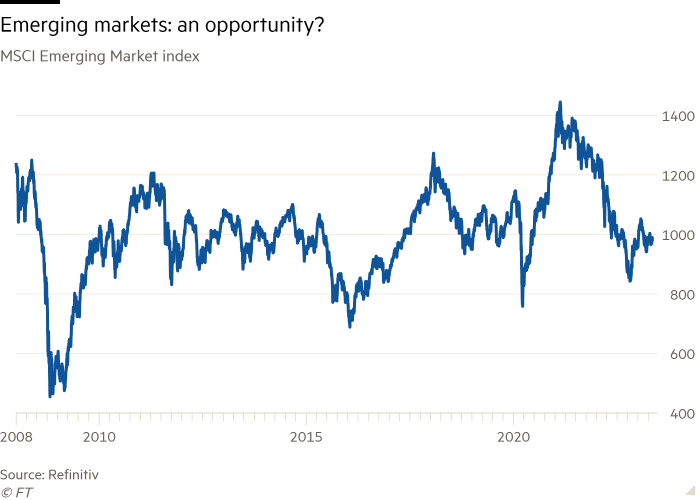

Another option is emerging market equities. The stock markets of developing countries performed extremely well in the early years of the millennium but crashed during the financial crisis. After another bad year in 2022, the MSCI Emerging Markets index is lower than it was before the 2008 crisis. At the start of this year, emerging market equities traded on a 35 per cent discount to developed markets on a price-earnings basis, according to Lazard Asset Management, and offered a dividend yield of 3.3 per cent versus developed markets’ 2.1 per cent.

To sum up, it may be worth combining a strategic asset allocation rule with tactical flexibility. Dividing the portfolio between equities and bonds will depend on the investor’s risk appetite and their view on the likelihood of inflation remaining high. Cautious investors who think inflation will subside will want more in bonds; more aggressive investors will want more in equities. Regular rebalancing will be needed, however, to keep the allocations close to the target.

Within those allocations, investors may at times want to have more in categories such as index-linked bonds or emerging markets if they seem to offer good bargains by historical standards. After all, a good chef knows how to improvise when they don’t have all the right ingredients.

Letter in response to this article:

Buffett’s mentor gave credit to investor attitudes / From David Coombs, Corby, Northamptonshire, UK

Comments