In charts: Green and sustainability bonds

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

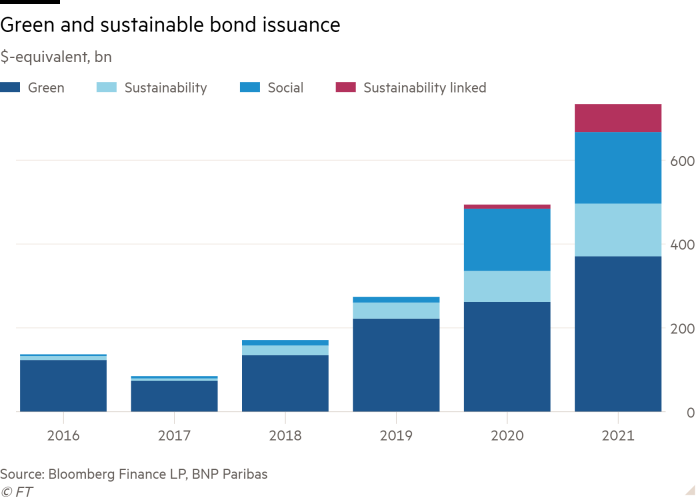

The market for green bonds continues to grow, with sustainability-linked securities seeing the biggest leap in issuance this year, up from 2 per cent of the total in 2020 to 9 per cent now.

By mid November, more than $80bn of these had been issued year-to-date, out of a forecast green bond total of $740bn.

But sustainability-linked bonds (SLBs) have become the subject of much debate, in light of their rising popularity. Critics are concerned that they may be a vehicle for less scrupulous corporate bond issuers to avoid the scrutiny applied to more conventional green bonds, which have stricter rules on how the capital raised is used to fund specific projects.

According to the International Capital Markets Association, there has been an uptick in corporates including their greenhouse gas emissions targets in the performance indicators for SLBs. This may be indicative of the changing regulatory horizon and the impetus provided by this month’s UN COP26 climate conference. However, whether greenhouse gas target metrics go far enough is yet to be determined. It may muddy the waters when it comes to discerning which companies are actually doing what on climate.

Still, some believe that SLBs provide a means of addressing funding gaps exposed and exacerbated by the pandemic — notably in emerging markets where the lines between environmental and social issues are less clearly drawn — and providing the long-term funding needed to meet UN Sustainable Development Goals. So far, though, there have been variable outcomes as to their efficacy.

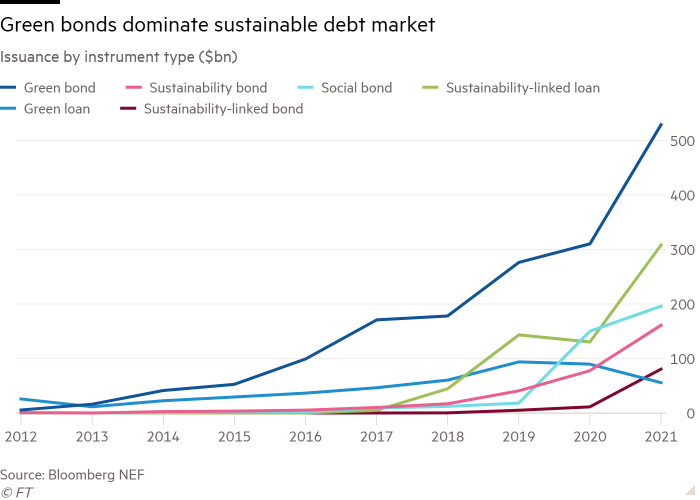

Overall, conventional green bonds remain the most popular of all sustainable debt instruments, making up half of the issuance in the sector from January to October this year: in excess of $370bn.

Emerging markets green bonds now have a market size of $180bn, of which nearly US$20bn consists of social, sustainability, and sustainability-linked bonds.

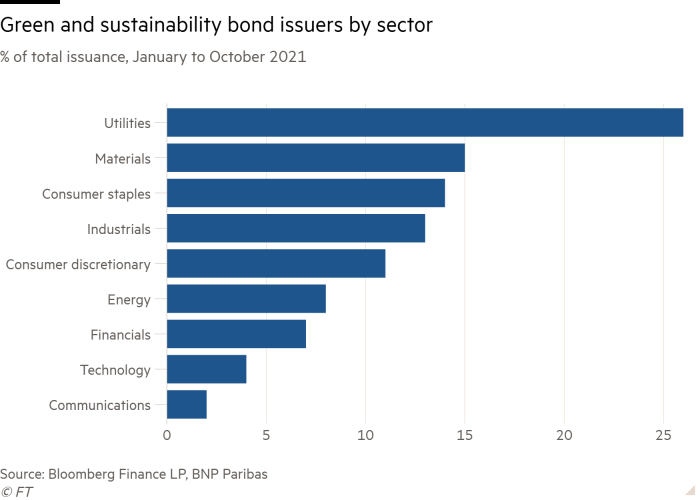

Of the companies issuing green and sustainability bonds in 2021, utilities dominate, accounting for just over a quarter of the total up to October.

However, companies in an increasing variety of sectors have also approached the market with bond offerings. Among the sectors (and companies) noted by the International Capital Markets Association are real estate (Hammerson), telecoms (Lumen, KPN), aviation (Aeroporti di Roma), oil & gas (ENI, Repsol) and banking (Berlin Hyp, China Construction Bank).

Hammerson — which owns a series of shopping malls in the UK, France and Ireland, including the Bullring in Birmingham and Brent Cross in London — launched a €700m SLB this year.

By contrast, tech and communications companies have made least use of green and sustainability bonds for fundraising, so far.

Comments