Stocks fall, insiders buy

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

If the US slips into recession, insiders will be the bag holders. That’s one conclusion to take from the latest update from JPMorgan’s quant team, which suggests that but for record levels of corporate equity purchases in the year to date, the US market correction would have been much worse.

It finds that 2022 has already been the worst since ‘Nam . . .

. . . . and fighting that trend, equity buybacks are likely to reach an unprecedented $600bn in the first half.

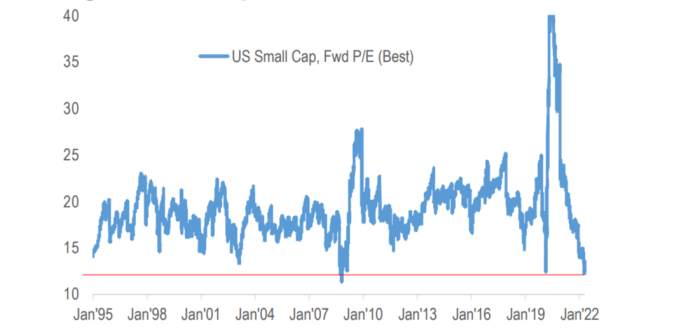

Share repos were running three-to four-times above the trend in recent weeks, JPMorgan says, and the internal plunge protection teams still have plenty of ammo left. Ex-financial S&P 500 companies are sitting on $1.9tn in cash, its screen shows — that’s some 219 US companies valued above $1bn with 25 per cent or more their market cap in cash.

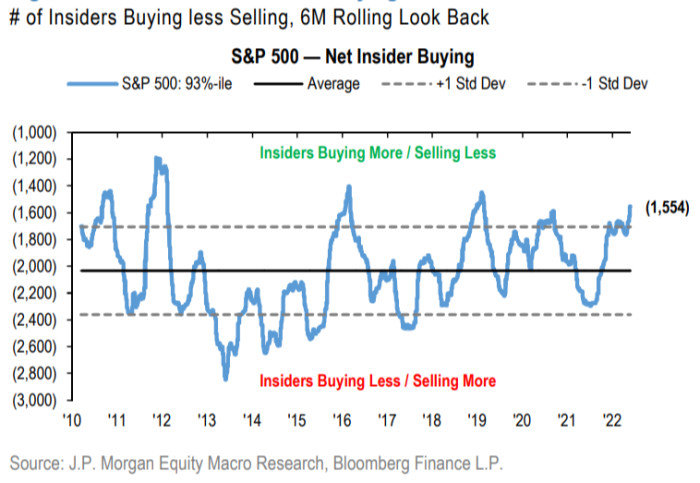

But directors haven’t just been using shareholder money to buy the dip. Insider buy-to-sell ratios in sectors including tech and communications are running at their highest levels since 2012. There’s the marketwide view:

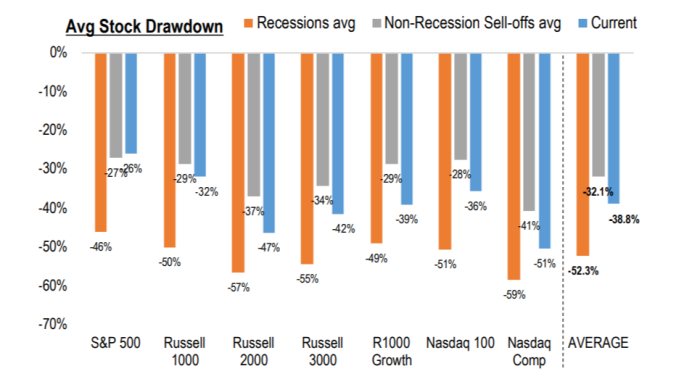

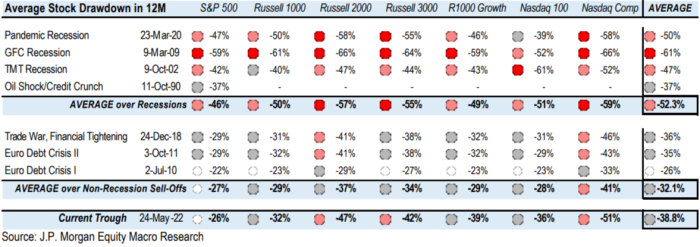

Without companies acting as buyers of last resort, investor positioning would look even more bearish than suggested by the S&P 500’s drop from peak levels, JPMorgan says. Its team advises to use average declines rather than capitalisation-weighted index levels for a clearer picture, as it takes better account of companies less able to use buybacks to cushion their fall:

“Anything short of a recession will probably catch most investors completely wrong footed, in our view, especially after broad and severe drawdowns that are 75 per cent of the way to prior recession bottoms,” writes the strategy team led by Dubravko Lakos-Bujas.

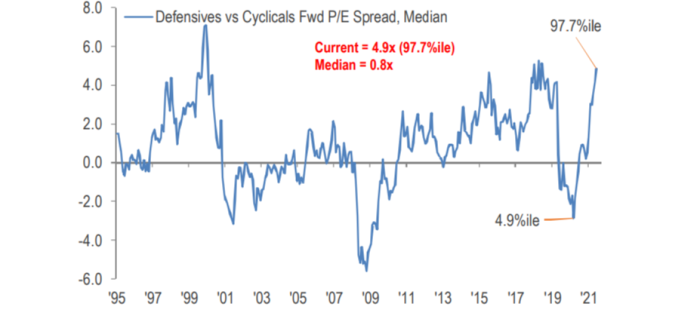

All of which shines the spotlight on the recession-tolerant US defensive sectors, which are trading at a near record premium versus cyclicals.

If the US somehow dodges recession, investors would be expected to rotate back out of this lopsidedly defensive position. And if recession does happen, “they will get annihilated anyhow under the last one standing doctrine used as a source of liquidity funding,” adds JPMorgan sales trader Jack Atherton. “You should start preparing for either scenario.”

Comments