Legal collaboration led to PG&E deal for victims of wildfires

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Few companies provoke more ire in their home state than California-based Pacific Gas & Electric. In June, the energy utility pleaded guilty to 84 counts of manslaughter, the result of its transmission equipment causing the state’s most devastating wildfire in 2018.

The company was already on probation for convictions that followed the 2010 explosion of one of its natural gas pipelines, which killed eight people. In the background, Californians have for years endured planned outages as the company sought to avert more wildfires.

Yet for some, the last straw was when PG&E filed for bankruptcy in January 2019, for fear it would be unable to pay an expected $30bn in damages to wildfire victims.

Erin Brockovich, the consumer activist who was also part of a legal team representing some of the victims of a 2017 wildfire, urged California’s governor to halt proceedings. Ms Brockovich’s fight against PG&E in the 1990s over a toxic chemical released into southern Californian water supplies inspired a 2000 movie about her, starring Julia Roberts.

In the 2019 case, Ms Brockovich doubts PG&E ever needed to file for bankruptcy, even though the company insisted it was necessary. “This is just what these companies do to get out of trouble,” she says. “Nobody wants to see them go bankrupt. But unfortunately, they don’t seem to do the right thing in the first place.”

The PG&E case was the largest restructuring case filed in California and the sixth-largest in the country, says Michael Stamer, part of the Akin Gump Strauss Hauer & Feld team that represented the holders of $10bn in PG&E debt. His clients included asset manager Pimco and billionaire investor Paul Singer’s hedge fund, Elliott Management.

But while Akin was representing the interests of institutional money, Mr Stamer and his colleagues quickly realised that the complex case called for a more multidisciplinary, project-managed approach than a conventional bankruptcy.

“When we first got involved in the case, everybody we talked to — in the governor’s office, the California Public Utilities Commission, the fire victims, investors or contractors — had a consistent sentiment,” says Mr Stamer. “They were unhappy and wanted to find an economic solution. The company needed to emerge from bankruptcy. Quickly.”

Adding to the pressure, California governor Gavin Newsom put a time limit on proceedings. If a deal could not be struck by June 30 2020, PG&E would not be eligible to participate in a crucial wildfire insurance fund established by the California legislature. Akin Gump believed more co-operation between the various parties would be needed to meet the governor’s deadline.

The utility had so many problems that it might have stayed in bankruptcy for years, says Mr Stamer.

One of the biggest challenges in reaching a global settlement was the bankruptee’s initial exclusive right to suggest its own restructuring plan. The exclusivity rule exists to ease the reorganisation process after a bankruptcy, since there is often more potential for chaos and uncertainty when other parties start suggesting restructuring plans, says Mr Stamer.

Yet he and his colleagues David Botter and Abid Qureshi judged that any proposal from PG&E would leave too much value in the hands of the utility’s existing equity owners, at the expense of the bond-holders and the wildfire victims.

When PG&E failed to develop a plan, Akin Gump put together a proposal to pitch to the judge. “When you’re litigating in bankruptcy court, you need to propose something that is executable,” says Mr Qureshi.

At first the judge rejected the plan. “Bankruptcy courts are generally deferential to the debtors and let them drive the bus for an extended period of time,” says Mr Stamer. “But we knew that our judge was more open-minded.”

Akin Gump tried again, working in an innovative collaboration with both its own clients and the tort victims’ lawyers to find a solution. “The second time around we knew three things needed to come together: a deal with the victims, the support of the governor’s office and ironclad financing,” says Mr Qureshi.

Robert Julian, a high-stakes complex litigation rainmaker, had come out of retirement to help the victims and represent the committee of tort plaintiffs, co-ordinating with scores of lawyers representing 70,000 claimants. “The biggest problem in the case was that there were thousands of northern Californians whose lives were totally upended and destroyed,” says Mr Julian, now a partner in San Francisco at BakerHostetler. “It was a challenge for us to repeatedly get that point across.”

Akin Gump approached Mr Julian with a fully financed offer that provided for $24bn in cash and PG&E stock for the victims. Put to a vote, the tort plaintiffs accepted the offer. “To have everyone at the table, and each party with a voice, that’s what’s important,” says Ms Brockovich of the settlement. “The consumer needs to have that voice. I’m really glad the victims got to vote. They’re the ones that matter. They’re the ones that lost loved ones and their properties.”

For Mr Julian, it was important to have “creative result-oriented lawyers” who realise that “time, value, money and speed is everything for the people who have lost everything and need to start again”.

The offer was sufficient to convince the court, and eventually led to a settlement of $25.5bn — including $13.5bn in cash and $6.75bn in stock for the victims of fires in 2015, 2017 and 2018 — and $11bn for insurance companies to pay out claims. Mr Julian says it was one of the largest mass tort recoveries, completed in record time: 18 months.

Not all parties were satisfied with the settlement, and there were some dissenting fire victims. But Mr Julian was confident it was the best deal available. Throughout the process, PG&E says it focused on getting victims “paid fairly and quickly”, while continuing to “deliver safe and reliable electric and gas service” and implementing needed changes across the business, “to improve operations for the long term”.

“Working with many stakeholders, including the governor’s office and the California Public Utilities Commission, our restructuring plan included a settlement valued at approximately $25.5bn to resolve wildfire claims; achieved significant savings for our customers through refinanced debt, estimated at approximately $250m annually; and assumed all current power purchase agreements to help the state reach its ambitious clean energy goals as we work to make our system more climate resilient,” says John Simon, PG&E general counsel.

For Ms Brockovich, a good settlement is one that “gets people back on their feet and helps keep PG&E honest”. “The victims who voted felt the settlement was fair — as fair as it could be, considering they burned down mostly an entire town,” she says. “Let’s not forget how many people perished in that fire.”

Case studies: the practice of law

Researched and compiled by RSG Consulting. ‘Winner’ indicates the organisation has won an FT Innovative Lawyers 2020 award; other firms are listed alphabetically

Client relationship management

The classic service-supplier relationship between law firms and their clients is changing. Underpinned by technology, relationships are becoming more equal and collaborative partnerships.

WINNER: White & Case

The firm, which has worked with Deutsche Bank since 1907, responded to the bank’s request to its panel firms for a new engagement structure. Aside from key relationship partners, the newly restructured White & Case team also consists of legal tech and knowledge management experts, and legal project managers who control much of what was previously handled by a handful of partners. It provides real-time feedback tracking on performance and fees, which are often fixed.

Baker McKenzie

The firm developed the 3R model to help companies navigate the business and legal impact of Covid-19. The model focuses on three phases of coping with the challenges of the pandemic: resilience, recovery and renewal. Designed in February 2020, the model has been rolled out globally to help staff structure the advice, tools and resources that they provide to clients.

Orrick

The firm created Privacy in a Box: a suite of policies, tools and templates for clients dealing with data challenges. The service is run through Joinder, collaboration software built by the firm, and access is offered to existing clients free of charge.

For now, the service is tailored to companies’ data privacy questions, but Orrick plans to expand it. Similar models for anti-corruption, antitrust and trade are in development.

Finance — unlocking capital

By working in the background to break deadlocks, helping clients unlock liquidity is a key value lawyers offer in times of crisis.

WINNER: Kirkland & Ellis

When it became clear the pandemic would have a catastrophic impact on Macy’s sales, the retail group decided to forgo its normal legal counsel in favour of the lawyers at Kirkland & Ellis.

The company was unable to take out a loan by pledging collateral because of historic bond agreements, so the lawyers worked with the legal team and financial advisers to create a holding company, moving Macy’s assets and taking out a $2.8bn loan against its inventory. This meant the company did not need to file for bankruptcy.

Akin Gump Strauss Hauer & Feld

When Californian utility Pacific Gas & Electric was undergoing restructuring in the face of major litigation because of its culpability for wildfires in the state, the law firm represented bondholders in challenging PG&E’s right to pursue its own restructuring plan to the detriment of bondholders. The lawyers negotiated a deal with the tort victims, assuring them of higher compensation rates, which persuaded the judge the case was best served by allowing the bondholders to pursue their own restructuring plan. The conflicting plans were then resolved via mediation, resulting in better rates for bondholders, $25.5bn for victims, and PG&E being able to participate in California’s wildfire fund.

Cadwalader, Wickersham & Taft

Blank-cheque companies, or special-purpose acquisition companies (Spacs), are created to raise investor capital through a listing on a stock exchange before hunting for a company with which to merge. The law firm helped billionaire Bill Ackman’s hedge fund Pershing Square create a $4bn Spac, many times larger than any other blank-cheque company in the market. The firm created novel features, including a structure that rewards long-term investors and a tontine that puts Pershing on a more equitable status with investors, thus making the investment more attractive.

Cravath, Swaine & Moore

In 2018, utility Pacific Gas & Electric faced multi-billion-dollar claims relating to causing Californian wildfires and was forced to file for bankruptcy. For it to be eligible for a wildfire insurance fund set up by the state of California for utility companies to protect against future litigation costs, the firm resolved its bankruptcy proceedings by a deadline of June 30 this year. The settlement involved resolving 20 mass tort claims.

Mayer Brown

The firm advised Goldman Sachs on a £6.8bn financing plan through United Airlines’ loyalty programme, MileagePlus, to help the airline increase revenue. The firm designed a structure with the bank that protects the bank lenders and the airline’s bondholders in the eventuality that the airline files for bankruptcy, by separating MileagePlus assets from United Airlines’ business.

Orrick

After receiving a donation of $65m from the Charles and Helen Schwab Foundation to build affordable housing in San Francisco, the non-profit San Francisco Housing Accelerator Fund worked with Orrick on a housing structure that combines low-income housing tax credit, a public loan sale, a long-term lease with the city and a lease back to the developer to fund the project. The 146 apartments are due to be completed in 2021. It is at least 25 per cent more cost effective than previous funding methods and will take three years to complete rather than the usual six for projects of this kind.

Osler, Hoskin & Harcourt

The firm helped obtain regulatory approval for the limited recourse capital note, a debt instrument that can be treated as debt by investors but as equity by regulators — providing Canadian banks with a new source of capital. The lawyers ensured the security would be tax-efficient, meeting all the post-2008 financial crisis regulatory requirements to be considered additional tier 1 (AT1) capital, similar to preferred shares, and also have tax-deductible interest. It is an attractive investment opportunity for institutional investors that normally would not be interested in preferred shares and it can be distributed to international markets. It has been used twice by Royal Bank of Canada to raise a total of $3bn, and by four other banks in Canada.

Paul, Weiss, Rifkind, Wharton & Garrison

The law firm advised several Wall Street investment firms, including Oak Hill, Apollo and KKR, on the creation of dislocation funds to take advantage of low prices while the market was in crisis earlier this year. The lawyers helped to condense fundraising from several years to a matter of weeks. This had the immediate benefit of generating capital to provide additional liquidity to companies in crisis.

Digitising the practice of law

Going digital is about more than using technology. It is about a different relationship between clients and practitioners, in which data is used to enhance problem-solving and legal advice, putting user experience first.

WINNER: Littler Mendelson

Littler onDemand is a tech-based platform created by the firm to answer clients’ questions on employment law. During the pandemic lawyers have responded to more than 3,500 queries, with the information stored on the platform. Working with a major ecommerce company, the firm created a bespoke version of the platform to answer queries from the human resources department and triage more complex problems to Littler lawyers on retainer, or direct questions to clients’ in-house teams.

DLA Piper

The firm created Compliance Atlas, an app that allows clients to access compliance documents and edit policies on their mobile phone. The firm works with companies to tailor the app to their policies for a fixed fee. The app is then editable and owned by the company. Commended: Daniel Garen (shown)

Dorsey & Whitney

With technology vendors Neota Logic and Opus 2, the firm designed an interactive portal that allows clients’ employees to review compliance materials, take compliance quizzes, report concerns anonymously and access training materials. It has been customised for 20 clients so far.

Eversheds Sutherland

The litigation technology group, established in 2019, has increased firm lawyers’ adoption of technology by 20 per cent. The team has built 10 litigation tools, including Spoliation Scientist, which uses artificial intelligence to identify cases involving spoliation of evidence and enables clients to view state regulations.

Freshfields Bruckhaus Deringer

Lawyers in the firm’s US litigation team developed a more efficient document review process. By switching between litigators in different time zones, the team is able to work continuously. Trial lawyers can use the technology to review documents themselves, rather than outsourcing this. The approach was used in a nine-figure dispute in which the firm represented a sports media company. The team reviewed 85,000 documents in three days.

Mayer Brown

The firm collaborated with French investment bank Société Générale to develop an artificial intelligence product, Theolex. It analyses current and future enforcement risks by using publicly available negotiated settlement agreements with enforcement authorities and collecting them in a single database. This helps clients reduce legal costs in cross-border multi-agency regulatory investigations by up to 10 per cent. Commended: Joydeep Sengupta (shown)

McCarthy Tétrault

The Canadian firm’s MT>3 division, which focuses on ediscovery and information governance made up of litigators, technical analysts and project managers, teamed up with new law company Legility. The partnership allows the firm to access advanced ediscovery technology provided by legal tech company Relativity. MT>3’s services are being used by a public sector client for statistical analysis and reporting, including building a responsive database and training end users.

Proskauer

The firm’s private credit group has uploaded its proprietary data on credit, covering around 200 deals annually, to a cloud-based platform that provides real-time intelligence and insights on the market for its lawyers and clients. Additional features are being developed, including a private credit default index and an app for smartphones and desktops.

Stikeman Elliott

Competition lawyers at the firm have built a tool for automating analysis of public and client data for mergers and acquisitions to assess competition risk. The tool’s simplified presentation of risk provides more value to clients than long-form reports. It enables lawyers to create visual, more digestible presentations for regulators, speeding up the process of gaining regulatory approval for M&As. Commended: Michael Laskey

The rise of multidisciplinary teams

Traditionally, law firms have organised themselves around legal practice areas. Now they are called on by clients to organise themselves according to specific problems and questions. This topic-led approach heralds a big shift in how firms specialise and what constitutes legal knowledge.

WINNER: Morrison & Foerster

By combining food, agriculture and climate law in one practice, the firm helps businesses meet environmental, social and corporate governance goals and bring to market new technologies to address food shortages and climate change; clients include the Bill & Melinda Gates Foundation. The practice has expanded to offer services to investors and advice on Food and Drug Administration (FDA) approval and compliance, and has launched a Latin America desk. The practice pledged $2m in pro bono services for 2020, including a task force to help Californian small businesses.

Creel, García-Cuéllar, Aiza y Enríquez

As the fintech market in Mexico accelerates, Creel’s lawyers have structured and obtained regulatory approval for several firsts in the region including Mexico’s first fintech licence, issued to epayments company Nvio Pagos México. Other examples are a “banking as a service” agreement between Sabadell Mexico bank and Spanish start-up Fintonic, and US ride-sharing company Uber’s application to create an e-wallet.

Crowell & Moring

Having previously worked in government, members of the firm’s digital health team have an advantage when it comes to advising clients. They have helped for-profit healthcare company UnitedHealth Group prepare for incoming US legislation requiring healthcare organisations to share more data with patients and third-party app developers, advising the company as it developed a platform to make this data easily accessible. The team advises on data risk and finds areas where it can add value, such as contractual terms and proprietary rights.

Dentons

The firm’s HealthTech team provides a multidisciplinary service advising on topics such as cyber security and government relations. When the pandemic hit Canada, the team helped biomedical tech start-up Spartan Bioscience secure $150m worth of contracts with local and national governments in three months for its Covid-19 testing kits.

DLA Piper

The firm’s digital health practice consists of an eclectic mix of experts including a doctor, a biostatistician, a health economist and a former member of Congress, most of whom are also attorneys. These experts work together to advise clients in areas beyond legal advice. A recent example was helping medical device company Dexcom gain emergency FDA approval for its remote glucose-monitoring device for use on diabetes patients to reduce nurses’ exposure to Covid-19.

Reed Smith

The firm’s life sciences and healthcare industry group comprises lawyers and business analysts, allowing the firm to embed forensics and data analytics into its practice without outsourcing to external consultants, which also saves clients money. The team analyses clients’ systems, processes and data to add value. After a healthcare client was investigated by the US attorney-general for suspected abuses of a reimbursement system, Reed Smith built an app to analyse the data and disproved the state’s calculations.

Ropes & Gray

The firm launched the R&G Insights Lab, a legal consulting group that combines legal expertise with analytics and behavioural science specialists. It provides clients with data-driven and human-centred advice on legal, business and compliance problems. The service uses a flexible billing model to advise on topics such as corporate and investment strategies, culture reviews and assessments, and diversity and inclusion initiatives.

Enabling responses to Covid-19

The pandemic tests the ability of lawyers to activate and co-ordinate all their resources to help companies deal with an unprecedented volume of operational, regulatory and talent-based challenges.

WINNER: Ropes & Gray

Advised the Greater New York Hospital Association on devising protection for hospitals and healthcare professionals, which led to a state immunity shield law, and on privacy issues surrounding contact-tracing platforms in Massachusetts, New York and Illinois. The firm also advised vaccine company Novavax on its $167m acquisition of Praha Vaccines.

Arnold & Porter

The firm advised three life sciences companies on accessing funding or purchase agreements for Covid-19 vaccines, including AstraZeneca where the lawyers helped accelerate the timeline of production. The firm also negotiated contracts with the Coalition for Epidemic Preparedness Innovations, Gavi (the UN-backed vaccines alliance) and the Serum Institute of India to support production of vaccines for the World Health Organization (WHO) and low-income countries.

Blackstone Law Group

The firm is using its cyber threat intelligence platform, built in-house, to track cyber attacks relating to the coronavirus. The tool identifies malicious Covid-19 domain names every day to share with clients and reduce phishing attempts against clients’ networks. Blackstone has identified cyber attacks on more than 1,700 companies, including a state-sponsored attack on the WHO.

Crowell & Moring

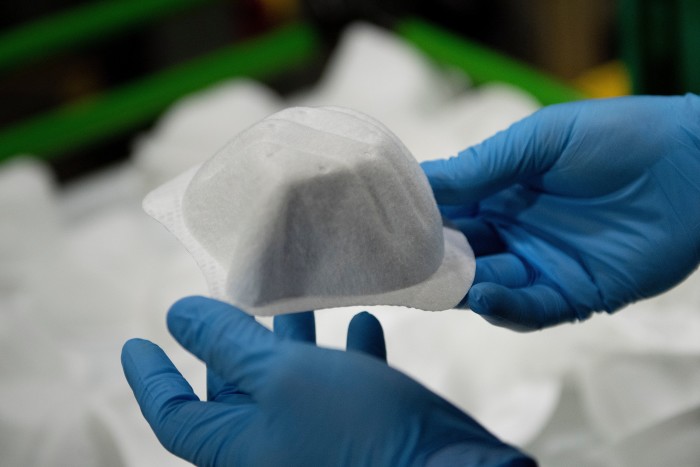

The firm is using its expertise in government contracts to help clients respond to the Covid-19 pandemic. It helped General Motors with contracting, to enable it to scale up its production of ventilators, enabling it to produce 30,000 machines by the end of August. Crowell & Moring also led negotiations with the US government for GM and US conglomerate Honeywell (below) to produce millions of N95 respirator masks.

Hogan Lovells

The firm advised carmaker Ford on its collaboration with GE Healthcare to produce 50,000 ventilators in 100 days. The firm also assisted the Kraft Group, owner of sports teams the New England Patriots and the Brooklyn Nets, on importing personal protective equipment (PPE) and ventilators from China, requiring the firm to navigate complex regulatory requirements in the middle of trade tensions between the US and China.

Hunton Andrews Kurth

Partner Torsten Kracht created a publicly available database of state and federal litigation about Covid-related claims. The complaint tracker helps clients and staff identify trends in litigation emerging from the pandemic. It has received more than 1,000 page views a week since it launched in April.

King & Spalding

In its life sciences and healthcare practices, the firm combines lawyers with scientists and ex-Food and Drug Administration regulators to advise clients. By managing contractual, regulatory and procurement challenges the firm helped medical device company Ventec Life Systems scale up its ventilator production to 10,000 a month. The firm is also advising two leading pharmaceutical manufacturers on the reputational risks associated with their development of a Covid-19 vaccine.

Kirkland & Ellis

The firm worked with pro bono legal services provider City Bar Justice Center and non-profit Lawyers for Good Government to launch the Small Business Remote Legal Clinic, which offers free legal consultations for small business owners (below) affected by the pandemic. Lawyers help business owners access grant and loan programmes and offer advice on commercial leases, contracts, insurance and employment. More than 1,700 volunteers from more than 100 firms and corporate legal departments have signed up to the programme.

McGuireWoods

The firm advised North Carolina-based non-profit hospital Novant Health on receiving special approval from the Federal Aviation Administration (FAA) to enable drone delivery company Zipline to deliver PPE and medical supplies contact-free.

It is the first time the FAA has allowed beyond-line-of-sight drone deliveries in the US; these could be used in future for testing, drug trials and vaccine distribution, for example.

Pillsbury Winthrop Shaw Pittman

The firm partnered with the Los Angeles Unified School District, which serves more than 600,000 students, to implement a Covid-19 testing plan to help students and teachers return safely to school (below). The firm led contract negotiations with Microsoft to implement an app that allows schools to track cases and identify high-risk areas, and also advised on data management and subscription licensing.

Seyfarth Shaw

At the start of lockdown in the US in April, the firm reached out to the National Retail Federation, an association of more than 16,000 businesses, to offer its services. The lawyers worked with Seyfarth Labs, the firm’s in-house technology team, to develop a virtual map providing daily updates on regionally specific restrictions applying to retailers, and built trackers advising on matters such as employment law and regulations for reopening businesses.

Sidley Austin

The firm advised non-profit organisation Helena on a project to purchase and ship 18.6m units of medical supplies to hospitals across the US and created a heat map to track supply and demand of PPE in real time.

The lawyers also advised on the best approaches for transit and distribution, including a partnership with the US army and air force, and the agreements signed with hospitals and suppliers.

Wilson Sonsini Goodrich & Rosati

The firm’s legal tech incubator SixFifty developed products to automate challenges relating to Covid-19, including a return-to-work toolkit used by more than 600 companies to help bring employees back into the workplace. It also created free tools such as Hello Landlord, an anti-eviction tool for tenants, and Hello Lender, which helps borrowers delay mortgage

payments.

Comments