5G rollouts offer ‘internet of things’ a more sophisticated outlook

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The “internet of things” (IoT) is often used as a catch-all phrase to describe the disparate items that use sensors to gather data — from driverless cars, to “smart cows”, to connected refrigerators, to robotic factories.

But with the broader adoption of IoT technology into data-intensive tasks, such as remote monitoring, diagnostics and healthcare, demand for 5G networks is similarly increasing.

The growing prevalence of 5G, which offers more speed, control and security than older networks, has enabled a more sophisticated world of IoT technology to emerge.

Growth in the use of automation, which has accelerated during the pandemic, has turned IoT into potentially big business.

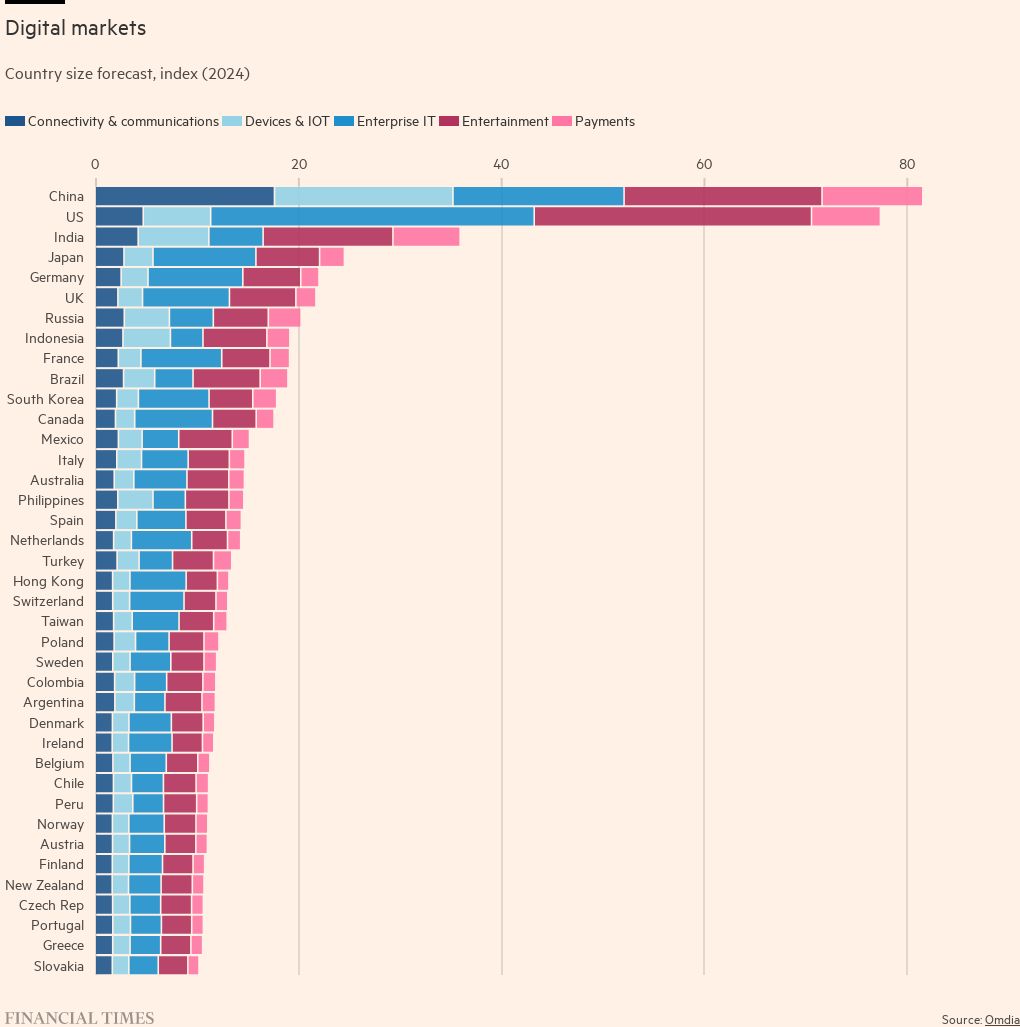

The Next Tech Growth Markets in Smart Devices

COUNTRIES TO WATCH 2020-2024

CHINA Driven by its large addressable market and wide deployment of low power technology, China’s IoT installed base will grow to 1.8bn by 2025.

GERMANY Growth in areas such as industrial automation will drive Germany’s IoT connections from 37m in 2021 to 46m in 2025.

US Uptake in areas such as consumer automotive will push up US IoT connections to 250m by 2025.

BRAZIL Brazil will continue to lead the Latin American market as a result of the growing use of IoT in the automotive, agriculture, and other sectors.

Source: FT-Omdia Digital Economies Index

Vodafone, the telecoms group that has long targeted IoT as a potential growth driver, said this month that it has grown the number of IoT SIM cards from 112m to 136m over the past year, making it the largest global connectivity provider. IoT generates almost €1bn a year in revenue for the UK-listed company, and that figure is growing at double-digit rates.

“We are going to continue to scale those businesses to continue to capture growth,” said Nick Read, chief executive of Vodafone, of the group’s IoT focus.

This picture of a booming IoT market is underlined by new data from Omdia, a technology consultancy, that shows more companies embracing IoT.

Its IoT Enterprise Survey found that nearly 70 per cent of companies it interviewed expected the technology to become a more important factor for their businesses over the next 18 months. Roughly half said the pandemic had accelerated their IoT plans, while almost two-thirds said that they would spend up to $5m on their IoT strategies.

“The massive disruption created by Covid-19 has largely increased enterprise demand for IoT solutions, which in many cases have allowed these businesses to maintain operations and ensure the safety of their employees,” says Joshua Builta, IoT research director at Omdia.

That has also had a knock-on effect for the consumer market.

“With every year, we connect more devices, at higher speeds, with more powerful processors,” says Paul Lee, head of telecoms, media and technology research at Deloitte, the professional services group.

“The benefit of connected devices is simply and significantly to make our lives easier,” he says. “A robot vacuum removes a chore; connecting this device enables it to learn from its mistakes.”

For Omdia, the pandemic is likely to drive further growth in smart TVs. Televisions had been a low-growth segment of the consumer electronics market in recent years, but smart sets became a “digital hearth” for many households during the pandemic. Increased viewing of streaming video services may encourage consumers to upgrade to newer smart TVs, Omdia’s analysts say.

There is likely to be less movement in the smartphone market, though, according to Omdia forecasts. Growth opportunities will be driven by the collapse of Huawei’s market share and the exit of LG, as opposed to higher demand for 5G phones.

China, the US and Germany are forecast to record the highest levels of growth in IoT in the coming years due to advances in industrial automation — in sectors including automotive and healthcare. Omdia sees China having an installed base of 1.8bn IoT devices by 2025, compared with 250m devices in the US.

Yet others expect a more muted performance in the short term. Dean Bubley, founder of tech consultancy Disruptive Analysis, says healthcare, logistics, warehousing and data centres have increased their scale during the pandemic to embrace automation.

However, hotels and live entertainment sectors have undershot expectations as their businesses were affected by lockdowns. The supply chain-led shortage of semiconductors could also stem growth.

“As the world recovers from the pandemic, IoT is also now staring down the barrel of semiconductor supply-chain constraints, so growth will continue to be patchy and inconsistent for at least another year,” Bubley warns.

Comments