In charts: Singapore’s trade

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Conveniently located at the tip of the Malay Peninsula, Singapore is one of the world’s most open economies with the value of its trade in goods and services equating to more than three times its overall economic output.

International trade with the “Lion City” has been strong over the past few years. By container load, the volume of goods that moved through the city’s port in 2018 was second only to Shanghai. However, overall trade began to dip last year and more recently the impact of the coronavirus on the movement of goods has taken its toll.

Most merchandise that enters the country is later “re-exported” to another destination. This allows companies to take advantage of Singapore’s many bilateral and regional trade agreements that either reduce or eliminate customs duties, making their exports more competitively priced.

Excluding trade in oil, about 60 per cent of goods leave Singapore in the same form as when they arrived from overseas; the rest are manufactured and produced within the country. This proportional split between domestic exports and re-exports has been relatively consistent over the past four decades as both grew in tandem.

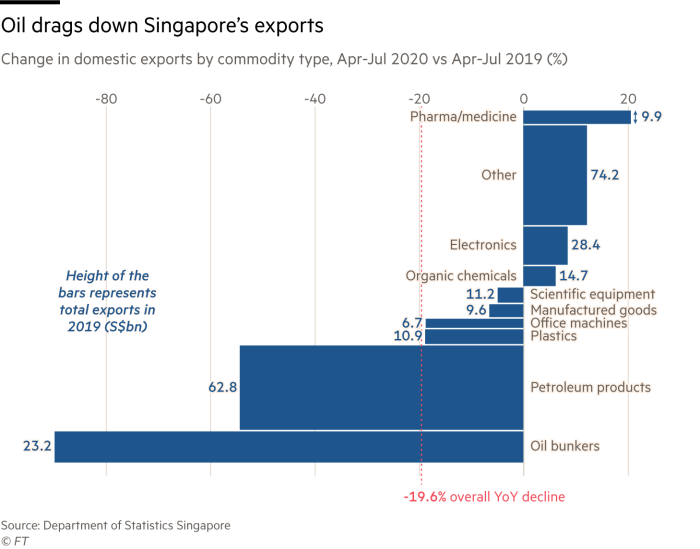

Singapore has developed particularly strong international markets for electronic goods and organic chemicals. Despite the imposition of measures to curb the spread of the coronavirus, exports for both categories along with pharmaceutical products rose between April and July this year compared with the same period in 2019.

Yet a lack of demand for oil and other related products has been a drag on the overall volume of exports leaving Singapore since the pandemic took hold.

The World Bank recently named Singapore as one of the easiest places to do business — helped by relatively low corporate and income tax rates — while a 2019 report by Transparency International, a non-governmental organisation, found that the city-state had one of the least corrupt public sectors. Investment in the country has improved as a result and demand for Singapore’s services has picked up.

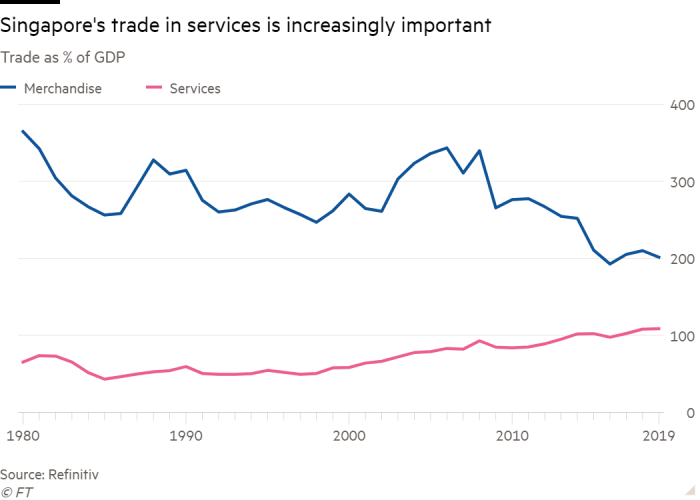

Services account for almost one-third of overall exports, compared with 15.8 per cent a decade and a half ago. Last year, Singapore’s overall trade in services had a value above 100 per cent of the country’s gross domestic product.

Meanwhile, the value of merchandise trade has been falling — dropping from as much as 343 per cent of economic output in 2006 to a little over 200 per cent last year.

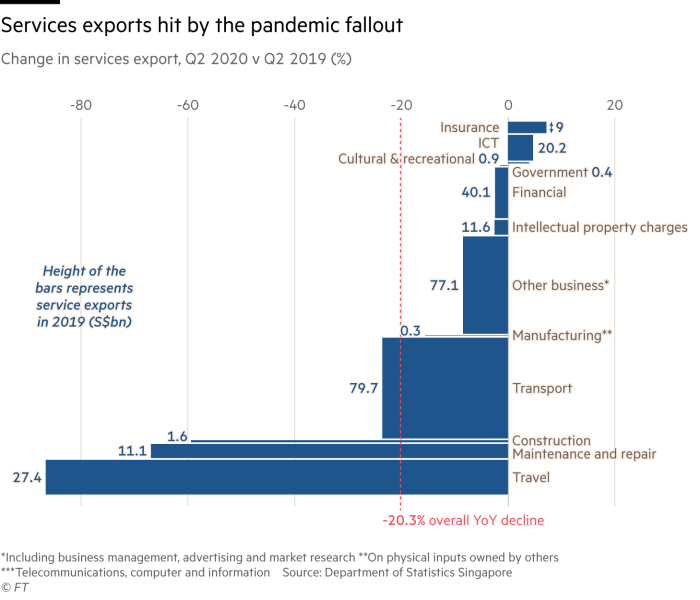

While a large part of the rise in services has been driven by more freight transport being provided from Singapore, the country also has a growing financial sector — the fifth most competitive in the world, according to the global financial centres index compiled by consultancy Z/Yen.

Additional services in business management, advertising and market research have also contributed to export service growth.

Yet exports in services have taken a hit since the pandemic struck. Restrictions stemming from the pandemic have prompted falls in travel and transport-related services of 86.5 and 23.5 per cent respectively in the second quarter of 2020, compared with the same period in 2019. Together, these services accounted for almost 40 per cent of overall service exports last year.

Comments