Stocks and bonds are still not cheap

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is a founder and chief investment officer at AQR Capital Management

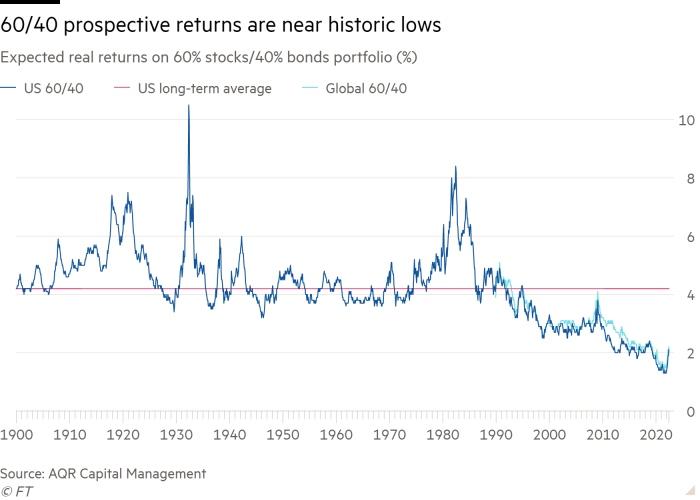

My colleagues and I have been saying for years that traditional portfolios are expensive and therefore face low prospective returns over the long term. In fact, expected returns for such portfolios with 60 per cent funds in equities and 40 per cent in bonds appear to have been hovering around the lowest ever.

However, our prediction had not panned out — until recently (frankly we would prefer it never did, we like markets to go up too). But that is not surprising, as long-horizon predictions just are not about short-term market timing.

Stocks, bonds and a range of other asset classes have struggled this year amid persistent inflation, hawkish central bank responses, geopolitical turmoil and recession concerns. Much of this has come from a reversal of the low and seemingly always falling real interest rates that kept markets high. The silver lining, some may hope, is that after all we have seen this year, markets may finally be cheap.

Unfortunately, they are not. Yes, markets are not as expensive as they were at the start of the year, but a few months of cheapening after a decade-plus of richening is a tiny drop in an awfully large bucket. We still live squarely in the world of low expected returns over the long term for most traditional investments.

What is the solution? Something investors likely already know, but may have abandoned during an exceptionally long bull market: diversification. But when it comes to diversification, we need to be careful. Just because something appears different does not mean it is diversifying, and just because something is called an “alternative” does not mean it is not basically the same thing (private equity is still equity, for example).

The alternatives industry, while being a varied bunch, can be very roughly categorised as 1) strategies where most of the return relies on exposure to market factors such as private equity and private credit and 2) strategies where returns are mostly unrelated to the overall performance of capital markets such as some macro hedge funds, equity market neutral strategies and managed futures.

The first type, privates, has seen stupendous growth over the past decade — not surprising given those strategies, by and large, have posted very strong returns. But why? Undoubtedly, many of these managers are skilled, but the historically strong environment for stocks and bonds also helped. Any strategy with returns that are economically tied to markets should do well when markets do well, particularly if the bets are leveraged.

Privates also benefited from reported volatility that often greatly understates the risk of the actual assets — something I have (cheekily) labelled “volatility laundering”.

This understatement of risk has been so successful in attracting investors that it has perhaps inverted the typical illiquidity premium (the return boost from being willing to own illiquid assets) into a headwind. In effect, illiquidity has become a feature you would pay for, not a bug for which you would require compensation. Nevertheless, a long-term low-return environment for equities cannot be hidden from forever.

In comparison, the second type of alternatives has not had the same tailwinds. If anything, a strong trailing decade for stocks and bonds has led many to reduce their exposures to the truly diversifying types of investment due to disappointing relative returns (an unfair comparison, but that does not mean it does not happen). We collectively seem to learn and unlearn these lessons in a painfully cyclical manner.

Now, back to today. Markets are still offering much less than normal, and the first type of alternative is in this same boat. Frankly, many of the strategies that posted above-average returns over the past decade are more than likely to underperform over the next decade.

However, this is not the case for the second type of alternative. Because they mainly try to generate returns regardless of market direction, these strategies may prove to be the more valuable in the decade ahead. Given that these are our strategies, we are arguing here with obvious self-interest. But I would note that market-neutral strategies that go long cheap and short expensive stocks are actually at around record levels of cheapness. Another self-serving shoutout should go to managed futures, which often trails when beta — or tracking the market — is king but then shines when it is not (as in 2022).

The current environment is giving plenty of short- and long-term reasons to diversify. When investors are looking to alternatives, just make sure they are actually an alternative.

Comments