Investors struggle to trade eurozone debt without ECB safety net

Simply sign up to the Eurozone economy myFT Digest -- delivered directly to your inbox.

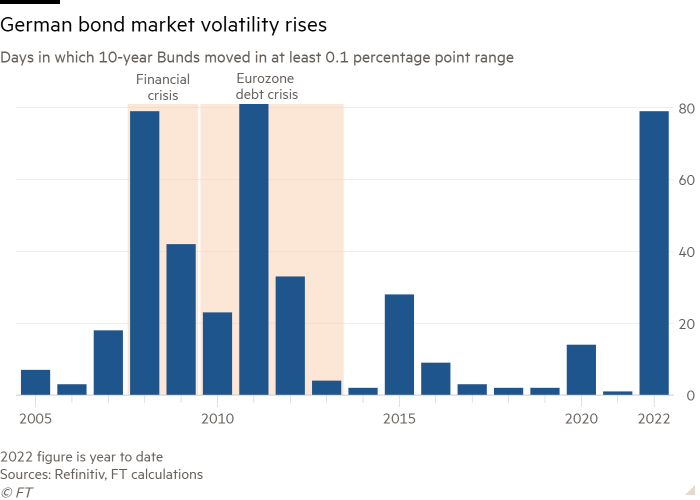

German government bonds are recording their biggest swings since the eurozone debt crisis a decade ago as the European Central Bank’s withdrawal strips the market of one of its most important buyers.

The deteriorating trading conditions have led to a strong uptick in volatility in a market that acts as a yardstick for borrowing costs across the region.

The yield on Germany’s 10-year Bund has moved in at least a 0.1 percentage point range on 79 days in 2022, according to Financial Times calculations based on Refinitiv data. Bund yields have not swung in such a wide range so regularly since 2011 and only did so on one day last year.

Liquidity in the region’s bond markets — the ability to trade debt easily — has been hampered by fears about a looming recession, with many growing bearish about the outlook as the ECB raises interest rates to curb red-hot inflation.

“Market conditions are impaired in the bond markets,” said Antoine Bouvet, senior rates strategist at Dutch bank ING. “Everyone has the same view so no one’s willing to take the other side.”

ECB rate-setters have been signalling that another half percentage point rate rise is likely at its meeting on September 8, after a similar-sized move last month. “Even if we entered a recession, it’s quite unlikely that inflationary pressures will abate by themselves,” ECB executive board member Isabel Schnabel said last week.

German central bank chief Joachim Nagel warned at the weekend that inflation in Europe’s largest economy was likely to surpass 10 per cent for the first time in 70 years. “With the high inflation rates, further interest rate hikes must follow,” he said.

At the same time, traders can no longer rely on the ECB as a guaranteed bond buyer of last resort, after the bank removed a critical safety net this year with the halting of its €1.7tn pandemic-era asset-purchasing programme and its main €3.3tn bond-buying scheme.

Italian bonds have also endured significant fluctuations in recent months. The spread between German and Italian 10-year yields — seen as a key gauge of risk — was close to 2.3 percentage points on Monday, its highest level for almost a month, highlighting anxiety over the outcome of Italy’s election next month and expectations of further rate rises by the ECB.

Higher rates and the prospect of a protracted global slowdown have prompted fund managers to reassess their portfolios, with many pulling money out of bond markets where value is being eroded by inflationary pressures. Some are instead sitting on cash, awaiting data releases for clues about the trajectory of European and US economies. Germany’s 10-year Bund yield has, for example, soared to 1.3 per cent from minus 0.18 per cent at the end of 2021.

Market activity typically quiets down during the summer months. But Bouvet said that even before entering the seasonal August lull, “the liquidity in the bond market was getting worse because of macro uncertainty [and] risk appetite being much more reduced”.

Poor liquidity has fuelled greater volatility, with bond prices swinging on ostensibly small developments and news. “[There’s] large pricing moves on not a lot and you also get a bit of dislocation,” said Lyn Graham-Taylor, senior rates strategist at Rabobank.

Snigdha Singh, co-head of European fixed income, currencies and commodities trading at Bank of America, noted that there were now fewer new sovereign and company bond deals across the continent. “Issuers will need to navigate volatile windows” if they want to come to market, she said, adding that “it certainly is conceivable that we could see some deals being postponed”.

Liquidity woes in debt markets have not been confined to the eurozone this year. Participants in the $23tn US Treasury market have also faced significant challenges, with William Marshall at Wall Street investment bank Goldman Sachs noting that US “market liquidity has been a prominent theme in rates [government bonds] this year”.

Craig Inches, head of rates and cash at Royal London Asset Management, said the global bond market conditions had led to rising bid-offer spreads, denoting the difference between the immediate sale price of an asset and its purchase price. Bid-offer spreads tend to expand during volatile markets and a wider gap usually points to worsening liquidity.

“Bid-offer spreads have become really quite large, especially when markets are moving quite quickly,” said Inches. “There may be an element where we get shown a price where we’d rather not pay that price to transact that trade.”

For now, central banks have ended bond-buying, or quantitative easing, but have not yet started to sell what they have on their books. Investors are divided over the likely impact of “quantitative tightening” when it happens, and are waiting with bated breath for the Bank of England to sell gilts into the market next month with a view to shrinking its balance sheet.

“When you have a major player pushing the market in a certain direction, that’s a problem,” said Bouvet. “That is spooky for any investors . . . Who’s going to take the other side of that and at what price?”

Are we heading towards a global recession? Our economics editor Chris Giles and US economics editor Colby Smith discussed this and how different countries are likely to react in our latest IG Live. Watch it here.

Comments