European stocks jump in first half of 2021 with ‘old economy’ in vogue

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

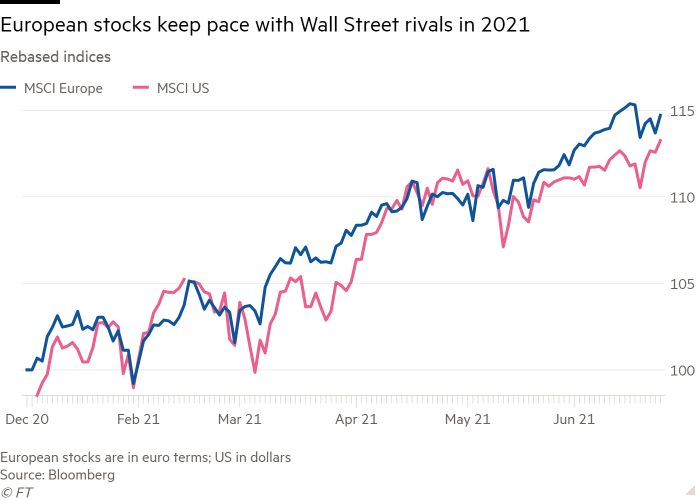

European stocks are neck and neck with their US rivals in the first six months of 2021 after trailing Wall Street for most of the coronavirus crisis, reflecting the widening rally across the global equities market.

MSCI’s broad barometer of European shares has raced ahead by almost 15 per cent in euro terms since the end of last year, outpacing the 13 per cent gains for American equities, tracked in US dollars. A rise in the greenback this year has eaten into the price returns for foreign investors in European stocks, however, leaving the MSCI Europe gauge up a slimmer 12 per cent on a dollar basis.

Investors in European shares have benefited as sectors considered to be sensitive to economic fluctuations such as banks and energy companies have gained favour as countries have lifted curbs on social activity. Since April, when economies on both sides of the Atlantic emerged from long periods of lockdown, enthusiasm for US tech stocks that had surged at the height of the pandemic has waned.

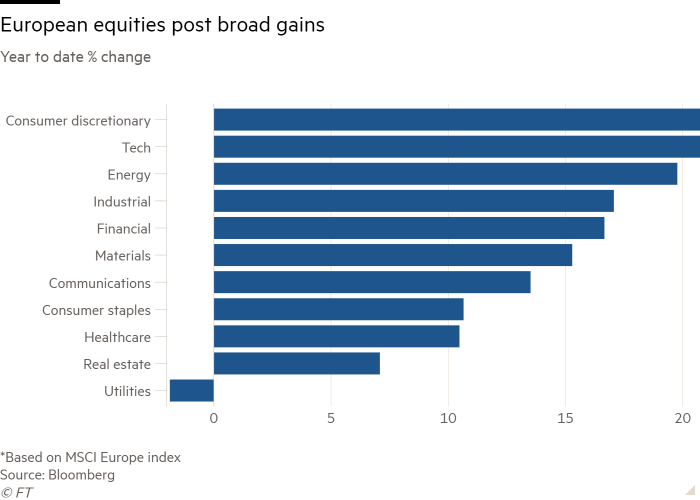

Gains in Europe this year have been broad, with the consumer discretionary, technology, energy, industrial, financial and basic material sectors all up more than 15 per cent, according to Bloomberg data. Only utilities, which are typically coveted for their consistent dividend payments, have declined as concerns over inflation have dented the appeal of those income streams.

Tom O’Hara, a portfolio manager at Janus Henderson, noted that many of the best performing sectors were so-called “old economy” industries that had been hit hard by the pandemic. Banks like Banco de Sabadell, Banco BPM and Société Générale, carmaker Porsche and glassmaker Saint-Gobain are all up more than 40 per cent in 2021.

Despite the recent rally for European bourses, Wall Street equities have posted a much more vigorous rally since the pandemic nadir last year. MSCI’s US index has jumped 95 per cent from its closing low on March 23 2020, while the European equivalent is up 62 per cent from its trough reached that same month.

Comments