First European defence ETF launches in the face of controversy

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Europeans have been given their first mainstream opportunity to invest in a defence exchange traded fund despite longstanding investor concerns about the sector.

Thirteen months after Russia’s full-scale invasion of Ukraine, the VanEck Defense Ucits ETF started trading on Wednesday on the London Stock Exchange under the ticker DFNS and Deutsche Börse’s Xetra as DFEN, and there are plans to list on Switzerland’s SIX and Borsa Italiana.

More than half of the companies it invests in supply hardware while the remainder are involved in information technology, operations and communications services. It comes with a hefty total expense ratio of 0.55 per cent.

“The defence sector has traditionally been a sensitive topic in Europe. However, since the start of the war in Ukraine, the views on security and defence policy have started shifting, as the need for security policy has become more obvious,” said Martijn Rozemuller, chief executive at VanEck Europe.

The sensitivity Rozemuller referred to is acknowledged. The fund follows the MarketVector Global Defense Industry Index, which excludes controversial investments such as those that contravene the Oslo Convention, which relates to cluster weapons, and the Ottawa Treaty, which relates to anti-personnel mines.

Companies that are involved with biological, chemical and incendiary weapons, white phosphorus, depleted uranium and nuclear weapons outside of the international non-proliferation treaty are also excluded.

Rozemuller said the launch of the ETF made sense given that many countries, in Europe in particular, had announced significant increases in defence spending.

BlackRock, which provides the world’s largest defence ETF, the $5.8bn iShares US Aerospace and Defence ETF (ITA), registered a European Ucits version of its fund in 2018 but it never came to market.

That meant there was no European vehicle able to capture the spike in performance enjoyed by defence ETFs after Russia’s invasion of Ukraine. Morningstar data indicates that the assets in ETFs with more than 40 per cent exposure to defence and aerospace stocks listed globally (excluding China) jumped 65 per cent between the end of January 2022, just before Russia’s invasion of Ukraine, and the end of March in the same year.

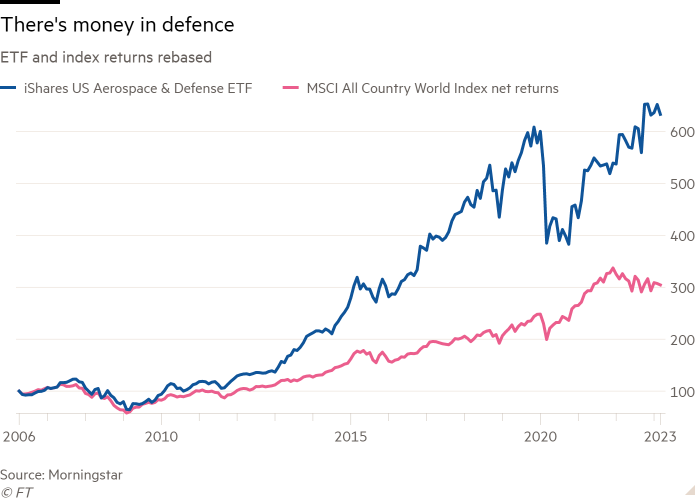

Since it launched in 2006 ITA, which tracks US defence stocks, has more than doubled the return of the MSCI All Country World Index, according to Morningstar.

Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said the decision to apply a filter to the portfolio made sense.

“I don’t think it is contradictory to exclude controversial weapons exposures within a defence fund,” he said. “That said, many ESG investors would balk at pouring money into defence contractors, particularly if the investment is to profit from bloodshed.”

Matt Tagliani, Emea head of product sales and strategy at Invesco, agreed. Its own US-listed Invesco Aerospace & Defense ETF launched in October 2005 and has about $1.8bn in assets under management.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

“We’ve had very interesting conversations with clients as this is obviously a hugely sensitive area that intersects with strongly held ethical and ideological views,” he said.

Tagliani pointed out that while one investor might see military spending as an irresponsible and immoral contribution to violence, another might believe that peace can only be maintained through strength and that governments have a moral obligation to protect their citizens.

“The fact that views are so strong — for many clients these are moral questions not financial ones — makes designing a product with broad appeal particularly challenging,” he added.

Comments