Investors should look to Europe when making their next move

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Equity investors in the past five months have already enjoyed the kind of performance that stacks up very nicely over a full calendar year.

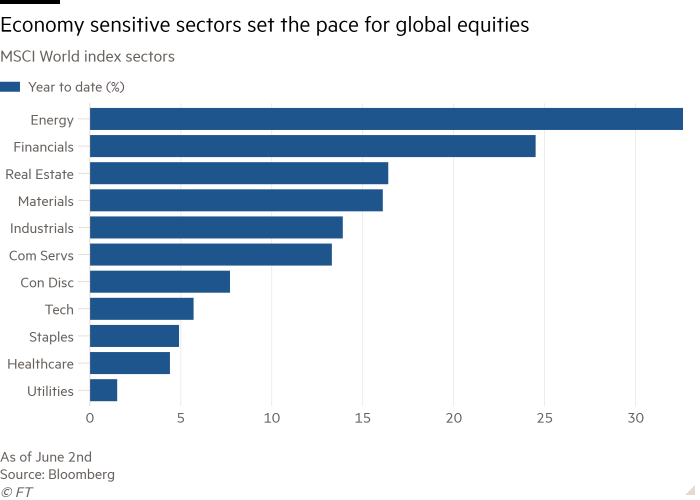

Many broad equity markets have appreciated impressively since the start of January. The MSCI World index of developed country shares kicked off June in record territory and has gained 11 per cent since January. For stock pickers, far stronger gains have been generated by companies in the energy and financial groups, areas buoyed by the prospect of reopening economies and a healthy boost to their corporate profitability.

The speed of the rally in many areas of the equity market does raise concerns that further scope for gains might prove challenging. Even with hefty infusions of monetary and fiscal stimulus coursing through the broader economy, the extent of this year’s capital appreciation from equities suggests a lot of good news has been discounted by investors.

“Share markets had a very good run in May and they look fully valued at the moment and they are vulnerable to any negative news,” says Chris Watling, chief market strategist at Longview Economics. Investor complacency is clearly evident, he adds, with “risk taking at high levels, rich valuations” and “global economic growth rates likely peaking”.

So should investors trim their sails and prepare for rougher water? In the near term that looks prudent. Taking a longer view, the shifts in equity markets so far this year bode better for European and global equities than for the US.

When it comes to Wall Street, the prospect of a sticky summer for investors should not be discounted. Attention is focused on when the Federal Reserve will signal that it is pulling back on its present full throttle of easy money, a shift that could spur another leg higher in 10-year bond market interest rates.

Since late last year, the appeal of owning faster-growing companies that dominate the S&P 500 has been dented by higher market rates. These reduce the value of future cash flows from the ranks of companies growing quickly, especially those that are non-profitable start-ups built on plenty of promise. Renewed pressure on technology shares that weigh on the S&P 500 is one possible outcome from a negative bond market reaction in the coming months.

True, higher interest rates signify a strengthening economy, and an improving bottom line for companies is an important driver of long-term equity performance. Wall Street analysts expect double-digit earnings growth over the remaining three quarters of 2021 for the S&P 500, according to FactSet. So far this year, bullish market sentiment has been affirmed by higher than expected earnings from companies. The growth rate of profits seen peaking in the current quarter is due in part to the comparison with very weak earnings amid lockdowns a year ago.

A challenge for investors is whether lofty expectations for US earnings growth over the rest of 2021 and into next year will still bear fruit when more companies are experiencing problems that may test profit margins and high equity valuations. This week’s release of the Fed’s Beige Book, a survey of businesses across the country, revealed labour shortages and supply-chain disruptions. It noted: “Looking forward, contacts anticipate facing cost increases and charging higher prices in coming months.”

These are issues that will probably beset other economies and in some countries turning the pandemic tide remains acutely challenging. What sticks out is how outside of the US, equity markets have enjoyed a strong run: the story of the past month has been one of European and UK shares outpacing the S&P 500 in both local and US dollar terms. That shift has played out as recent flows in US-listed exchange traded funds suggest there is “room for international equity allocation ETF flows to accelerate”, said Citi.

This week the Euro Stoxx 600 index climbed to a fresh peak and this does leave the market vulnerable to a pullback. Beyond near term market squalls, there are grounds for taking a more constructive approach towards global equities that have long lagged behind the tech-driven performance of Wall Street.

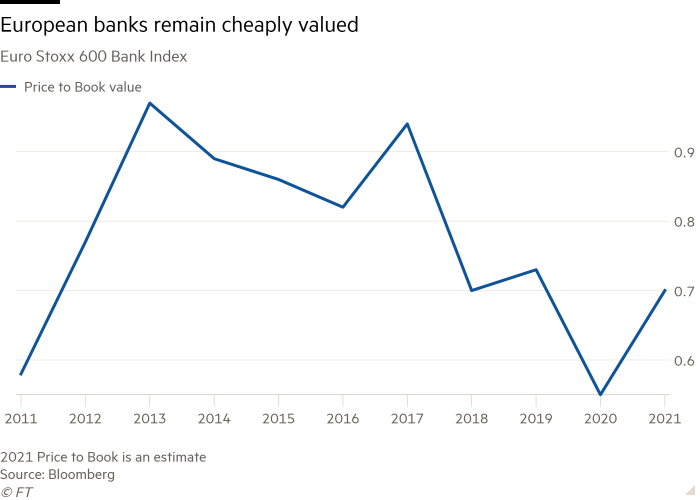

One area that will probably determine whether Europe can now prove a better place to park your money outside of the US is that of financials. Getting bullish on the sector in the past has been replete with false dawns. While Stoxx 600 banks as a group have risen 35 per cent this year, they still remain cheap when viewed in terms of the value of their balance sheets.

Accounting for the naturally higher pace of US corporate profitability, Colin Moore, global CIO at Columbia Threadneedle, believes there is a case for international markets doing relatively better for some time to come.

“After a prolonged period of US outperformance you should see Europe and EM start closing a large valuation gap,” he said. “Global equities are relatively cheap versus the US and that is the opportunity for investors.”

michael.mackenzie@ft.com

Comments