Bond portfolio trades are cheap as chips. Why?

Simply sign up to the Capital markets myFT Digest -- delivered directly to your inbox.

As we wrote a few weeks ago, fixed income portfolio trading is becoming A Big Deal. From virtually nothing five years ago, it now accounts for 8 per cent of US credit trading volumes, according to Barclays.

Barclays today released another report exploring why portfolio trading has exploded in popularity lately. Unsurprisingly in a market where transaction costs can gobble up a lot of returns, it largely comes down to costs.

For reference, a portfolio trade is when banks or investors trade a big basket of multiple bonds in one go, rather than one at a time. These portfolios can range from 10 to 10,000 bonds, for total values well north of $1bn in some cases. It’s the fixed income equivalent to trading a chunk of the entire S&P 500.

The savings can be significant. Jeff Meli, Barclays’ global head of research, estimates that portfolio trades reduces transaction costs by 41 per cent for investment grade corporate debt and 44 per cent for junk bonds, relative to where it would cost CUSIP-by-CUSIP. The scale of the savings begs the question: why?

The first obvious answer is that the big banks doing these trades for investor clients are buying market share in a hot area by bidding too aggressively. After all, they tend to be for big valuable clients. But Barclays is sceptical of this argument:

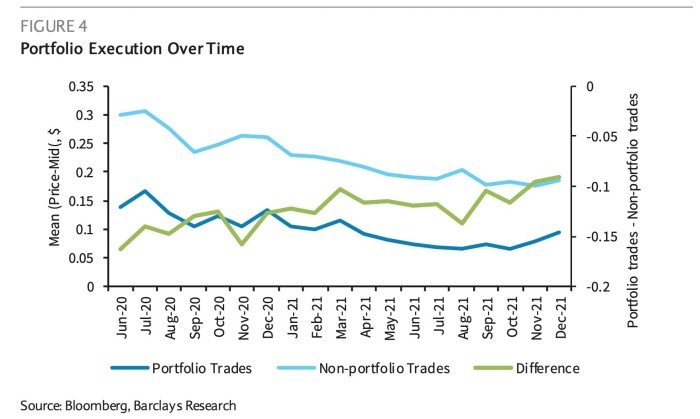

We discount the first theory based on evidence that the benefits of portfolio trading have remained constant over time, even while their volume has grown dramatically. If dealers were competing for volumes using this protocol, we would have expected the benefits to grow as more dealers became involved.

Here’s their chart showing how the cost savings haven’t changed much over time.

Barclays reckons two other theories better explain why the execution costs of portfolio trades are more modest: easier hedging of big fixed income portfolios as opposed to individual bonds; and the explosion of the ETF ecosystem.

Although it is easier to judge the riskiness of a single bond than a large jumble of them, the dramatic decline of the single-name credit-default swap market means that they are often tricky to hedge. Meanwhile, a large diversified portfolio can be hedged with still-vibrant CDS indices, total return swaps or other derivatives. Barclays:

Of course, the exact hedging strategies used by trading desks are quite complicated and likely vary across dealers and with market conditions. But a simple way to think about ease of hedging is to consider how much of the risk of a trade is systematic (and, thus, easier to hedge) versus idiosyncratic.

For example, portfolios that are all buys or all sells have mostly systematic risk, particularly since most portfolio trades have many line items of roughly equal size. A mixed portfolio (eg, one that is 50% buys and 50% sells) actually has very little systematic risk; the systematic risk of the long leg offsets that of the short leg, and only idiosyncratic risk remains. Therefore, one way to test if ease of hedging affects the pricing of portfolio trades is to compare the execution costs of portfolios that mix buys and sells to those that involve only buys or only sells.

But the biggest driver is what we talked about in the last post. The emergence and growth of a huge fixed income ETF market has unlocked a ton of options for both asset managers, hedge funds and banks.

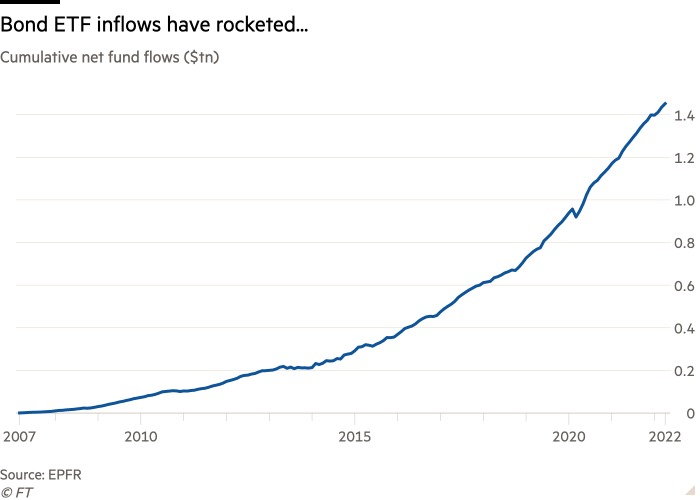

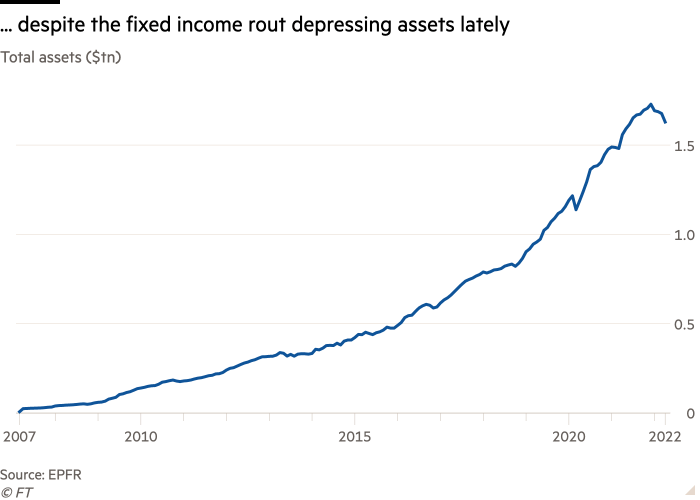

Here are two charts we made from EPFR Global data, showing how inflows have exploded over the past decade, and continued despite this year’s bond market wobble depressing overall assets a bit, from a peak of over $1.7tn at the end of last year to a still chunky $1.6tn today.

Trading volumes associated with ETFs have also jumped. At the end of 2021, 30 per cent of US junk bond trading and 15 per cent of investment-grade bond trading was generated by ETFs, up from 15 per cent and 7 per cent respectively in 2020, according to Barclays.

Fixed income ETFs enable portfolio trading both because of the creation-redemption process (dealers can use a broad representative basket of bonds to create new ETF shares, or redeem shares for a slice of the underlying bonds) and because they make hedging even easier.

Here’s Barclays’ summary:

Given the linkages between ETFs and portfolio trading, it is no surprise that the latter has been growing along with the volumes in the form er. In fact, the continued growth of ETFs may be essential to continued growth in portfolio trades. Particularly in IG, if the ETF ecosystem is necessary for dealers to be willing to provide good execution on illiquid bonds, the demand from ETFs puts a natural bound on the amount of portfolio trading . . .

. . . In IG, this ecosystem allows investors to crowdsource liquidity in illiquid CUSIPs that are owned by ETFs. Due to the “lifecycle” of liquidity in the IG market, whereby bonds become less liquid as they age, even the liquid sub-indices used as a benchmark by the largest IG ETFs have many very illiquid bonds. As a result, IG ETFs have significant demand for these CUSIPs. This explains why 49% of IG portfolios appear designed to crowdsource liquidity in some very illiquid bonds.

This is less relevant in HY because the largest ETFs own fewer illiquid bonds. However, the ease of hedging materially affects execution costs in HY portfolio trades. HY portfolios that are either all buys or all sells have significantly lower transaction costs than those mixing buys and sells. The former involve mostly systematic risk, which is easier to hedge; ETF overlap both allows dealers to use the create and redeem process as an outlet for risk, and makes hedging with the ETF even more efficient. This explains why 73% of HY portfolio trades are index — like. Ease of hedging has no effect on IG portfolio execution

Comments